Aerospace & Defense Investment Bank

LEADING PROVIDER OF M&A ADVISORY SERVICES

TO PRIVATELY HELD BUSINESSES

KAL Capital By The Numbers

0

Transactions

$0B+

TOTAL ENTERPRISE

VALUE

0+

YEARS COMBINED EXPERIENCE

0

AVERAGE ANNUAL TRANSACTIONS

$25-500M

TRANSACTION SIZE RANGE

Industries We Work With

Every day our team lives and breaths in these sectors, making us uniquely qualified to represent our client’s shareholders. KAL Capital will assist your team every step of the way to ensure above market results.

AEROSPACE

Servicing the entirety of the aerospace supply-chain, including OEM Manufacturing, Component MRO, and Ground Handling.

SPACE

Servicing the global commercial and defense-related space manufacturers and service providers.

DEFENSE

Advising service providers and manufacturers of mission-critical components and structures for defense platforms across the different branches of the military.

GOVERNMENT SERVICES

Advising the vast ecosystem of businesses providing services to the United States Department of Defense.

CRITICAL & EMERGING TECHNOLOGIES

Dynamic, single source of truth advisory tailored to critical & emerging technology founders throughout the defense and space innovation ecosystem.

Featured Transactions

KAL Capital is a leading investment banking firm in the aerospace and defense industry with a proven track record of successful transactions. Our team of experienced professionals possesses a wealth of knowledge and a vast network of industry connections, allowing us to successfully execute a multitude of transactions.

News & Updates

Aerospace and Defense Review for Q4 2025

Download PDF Here. Dear Friends, As we close the books on 2025 and enter the new year, Q4...

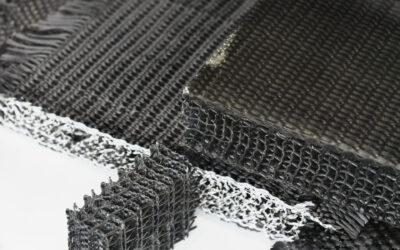

Seemann Composites Acquired by Karman Space & Defense (NYSE: KRMN)

LONG BEACH, Calif.--Karman Space & Defense (“Karman”, “Karman Holdings, Inc.” or “the...

Estes Energetics Acquired by Voyager (NYSE: VOYG)

PENROSE, CO–(KAL Capital Markets)–Estes Energetics ("Estes Energetics" or "the Company"), a...

Upcoming Events

Discover exceptional opportunities with KAL Capital. Join our upcoming events to explore investment insights and network with industry leaders.

Upcoming Events

Discover exceptional opportunities with KAL Capital. Join our upcoming events to explore investment insights and network with industry leaders.